Pacifica Silver Reports Additional Drill Results at Claudia with Multiple High-Grade Silver-Gold Intercepts at the Aguilareña Area

Vancouver, British Columbia--(Newsfile Corp. - February 18, 2026) - Pacifica Silver Corp. (CSE: PSIL) (OTCQB: PAGFF) ("Pacifica Silver" or the "Company") is pleased to announce assay results from the remaining nine holes of its Phase I diamond drilling program at the 100% owned Claudia Silver-Gold Project ("Project") located in the historic El Papantón Mining District in Durango State, Mexico. The Phase I program, comprising 30 holes for approximately 8,000 metres, was successfully completed in late December 2025, with initial results previously reported in news releases dated December 15, 2025, and February 9, 2026. The remaining nine holes were drilled at the principal Aguilareña and Guadalupana vein areas, with results discussed below.

Drill Highlights – Aguilareña Area

- Hole 25CLAU053D intersected 4.30 m grading 1.42 g/t Au and 221 g/t Ag (343 g/t AgEq*) from 72.55 m, including:

- 2.20 m @ 2.31 g/t Au and 409 g/t Ag, including 0.55 m @ 5.41 g/t Au and 1,180 g/t Ag.

- Hole 25CLAU054D returned two mineralized intervals:

- 4.25 m @ 1.25 g/t Au and 101 g/t Ag (208 g/t AgEq) from 80.65 m, including 1.35 m @ 2.18 g/t Au and 190 g/t Ag; and

- 2.35 m @ 1.51 g/t Au and 15 g/t Ag (145 g/t AgEq) from 185.35 m, including 1.00 m @ 2.81 g/t Au and 33 g/t Ag.

- Hole 25CLAU065D intersected two narrow, high-grade intervals in veins in the hanging wall:

- 0.30 m @ 12.30 g/t Au and 206 g/t Ag (1,264 g/t AgEq) from 96.20 m; and

- 0.30 m @ 22.30 g/t Au and 156 g/t Ag (2,074 g/t AgEq) from 166.60 m.

"These remaining results from our Phase I Drill Program have rounded out a successful maiden drill campaign that has extended the Aguilareña vein significantly down dip and confirmed the subsurface lateral continuity of the vein along 1.8 km of strike length," stated Todd Anthony, Chief Executive Officer of Pacifica Silver. "We are very excited by what we have seen during our inaugural program: these narrow, high-grade silver-gold intercepts are a hallmark of classic low-sulfidation epithermal systems and closely resemble the vein style of the nearby San Dimas Mine, which has successfully operated for hundreds of years on similar narrow, high-grade structures. We view these results as highly encouraging, fully aligned with the geological model we are systematically pursuing, and clearly indicative of the discovery potential of this large-scale, underexplored Project."

Discussion of Drill Results

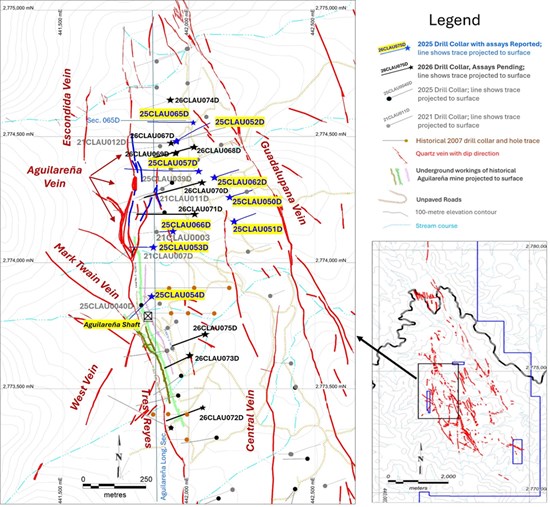

Silver and gold assay results are reported for holes corresponding to the following areas (Figure 1 – blue labels) and summarized in Table 1:

Aguilareña vein (northern area): Holes 25CLAU053D, 25CLAU054D, 25CLAU057D, 25CLAU065D, 25CLAU066D

Guadalupana vein: Holes 25CLAU050D, 25CLAU051D, 25CLAU052D, 25CLAU062D

Figure 1 – Map Showing Locations of 2025 Phase I Drill Program at Claudia Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10814/284243_b730434ec4b119a6_001full.jpg

Table 1 – Significant Assay Results from Phase I Drill Program at Claudia Project

| Hole ID | From m | To m | Length m | Au g/t | Ag g/t | AgEq** g/t | Area | |

| 25CLAU050D | 216.15 | 221.25 | 5.10 | NSI; max 0.29 g/t Au and 42 g/t Ag | Guadalupana vein | |||

| 25CLAU051D | 237.60 | 246.20 | 8.60 | NSI; max 0.35g/t Au and 12 g/t Ag | Guadalupana vein | |||

| and | 257.00 | 257.90 | 0.90 | at | 1.01 | 22 | 108 | footwall vein |

| 25CLAU052D | 142.35 | 143.90 | 1.55 | at ave | 0.94 | 33 | 114 | Guadalupana hanging wall vein |

| and | 284.40 | 295.10 | 10.70 | at ave | 0.33 | 11 | 39 | Guadalupana hanging wall stockwork |

| including | 294.75 | 295.10 | 0.35 | at | 0.40 | 6 | 40 | Guadalupana vein |

| 25CLAU053D | 72.55 | 86.90 | 14.35 | at ave | 0.76 | 73 | 139 | Aguilareña vein & footwall stockwork |

| and | 72.55 | 76.85 | 4.30 | at ave | 1.42 | 221 | 343 | Aguilareña Vein |

| including | 74.65 | 76.85 | 2.20 | at | 2.31 | 409 | 608 | |

| which includes | 76.30 | 76.85 | 0.55 | at | 5.41 | 1,180 | 1,645 | |

| 25CLAU054D | 80.65 | 88.95 | 8.30 | at ave | 0.89 | 62 | 139 | Aguilareña vein & footwall stockwork |

| including | 80.65 | 84.90 | 4.25 | at | 1.25 | 101 | 208 | Aguilareña vein |

| which includes | 80.65 | 82.00 | 1.35 | at | 2.18 | 190 | 378 | |

| and | 185.35 | 187.70 | 2.35 | at ave | 1.51 | 15 | 145 | Mark Twain vein |

| which includes | 186.70 | 187.70 | 1.00 | at | 2.81 | 33 | 274 | |

| 25CLAU057D | 260.95 | 262.30 | 1.35 | NSI; max 0.22 g/t Au and 11 g/t Ag | Aguilareña vein | |||

| 25CLAU062D | 219.70 | 221.40 | 1.70 | NSI; max 0.27 g/t Au and 56 g/t Ag | Guadalupana vein | |||

| 25CLAU065D | 96.20 | 96.50 | 0.30 | at | 12.30 | 206 | 1,264 | Aguilareña hanging wall vein |

| and | 166.60 | 166.90 | 0.30 | at | 22.30 | 156 | 2,074 | Aguilareña hanging wall vein |

| and | 222.85 | 225.05 | 2.20 | at ave | 0.49 | 10 | 52 | Aguilareña vein and stockwork |

| which includes | 222.85 | 223.35 | 0.50 | at | 1.76 | 28 | 180 | |

| and | 232.15 | 235.00 | 2.85 | at ave | 0.41 | 7 | 42 | Aguilareña vein and stockwork |

| including | 234.60 | 235.00 | 0.40 | at | 1.52 | 12 | 143 | |

| 25CLAU066D | 145.85 | 148.70 | 2.85 | at ave | 1.11 | 6 | 102 | Aguilareña hanging wall vein |

| which includes | 145.85 | 146.40 | 0.55 | at | 4.12 | 9 | 363 | |

| and | 151.70 | 155.55 | 3.85 | at ave | 0.71 | 12 | 73 | Aguilareña hanging wall stockwork |

| and | 167.75 | 174.90 | 7.15 | at ave | 0.64 | 13 | 68 | Aguilareña vein |

| which includes | 167.75 | 169.25 | 1.50 | at | 1.09 | 21 | 115 | |

NSI stands for "No Significant Intercepts"; Composites calculated with Au minimum of 0.15 g/t (0.100 g/t Au if Ag > 30 g/t) and no more than 1.0 m internal below minimum.

*True widths are estimated to average 75% of the reported drilled intervals (the majority range from 76% to 96%).

**Silver equivalent grade (AgEq) is calculated based on the following formula: AgEq (g/t) = Ag (g/t) + [Au (g/t) x (Au price / Ag price) x (Au recovery / Ag recovery)]. Metal prices for silver and gold are assumed to be US $30/oz and US $2,500/oz, respectively. At this stage, insufficient metallurgical test work has been completed to determine recoveries for silver and gold at the Claudia property. Accordingly, recoveries of 93% for silver and 96% for gold were applied, based on the 5-year historical average production data reported from First Majestic Silver Corp.'s San Dimas mine. These values are considered reasonable proxies for anticipated recoveries at Claudia due to similarities in deposit style and the relative proximity of the two properties.

Northern Aguilareña Area Results

Holes 25CLAU053D, 25CLAU054D, 25CLAU057D, 25CLAU065D and 25CLAU066D were drilled north of the Aguilareña shaft. Apart from 25CLAU053D (up-dip test), all holes targeted extensions of the Aguilareña vein down-dip and laterally from historical drilling with results discussed below.

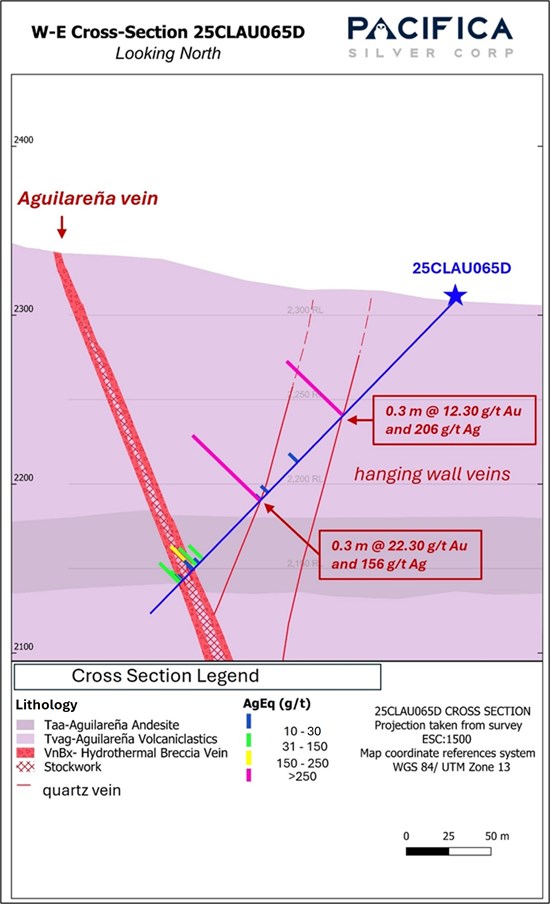

- Hole 25CLAU065D, which returned the highest-grade gold intercepts, was drilled as a 120-m step-out to the north at the same elevation as drill hole 25CLAU039D (previously reported). The hole specifically targeted the ~150-m gap between historical holes 21CLAU012D and 21CLAU025D. The hole discovered two narrow, previously unrecognized veins that do not crop out at surface, intersecting:

- 0.30 m @ 12.3 g/t Au and 206 g/t Ag (from 96.20 m); and

- 0.30 m @ 22.3 g/t Au and 156 g/t Ag (from 166.60 m).

- The Aguilareña vein and adjacent hanging wall stockwork zone were intersected over a drilled width of 12.15 m from 222.85 m, including:

- 0.50 m @ 1.76 g/t Au and 28 g/t Ag, from 222.85 m; and

- 0.40 m @ 1.52 g/t Au and 12 g/t Ag from 234.6 m.

- An east-west cross section showing the newly discovered, high-grade hanging wall veins and the Aguilareña vein, is presented in Figure 2.

Figure 2 – Hole 25CLAU065D Cross-Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10814/284243_figure2.jpg

- Hole 25CLAU053D, drilled up-dip from historical hole 21CLAU007D, intersected the Aguilareña vein and associated stockwork over a drilled width of 14.35 m, including:

- 0.55 m @ 5.41 g/t Au and 1,180 g/t Ag over (from 76.30 m) within a broader interval of 2.20 m @ 2.31 g/t Au and 409 g/t Ag (from 74.65 m).

- Hole 25CLAU054D extended the Aguilareña vein down-dip from previously reported hole 25CLAU040D, intersecting vein and mineralized stockwork over 8.3 m, including:

- 1.35 m @ 2.18 g/t Au and 190 g/t Ag within a broader interval of 4.25 m @ 1.25 g/t Au and 101 g/t Ag (from 80.65 m).

- 1.00 m @ 2.81 g/t Au and 33 g/t Ag within a broader interval of 2.35 m @ 1.51 g/t Au and 15 g/t Ag from 185.35 m.

- Hole 25CLAU057D extended the Aguilareña vein approximately 75 m down-dip from historical hole 21CLAU011D, intersecting the vein over a drilled width of 1.35 m (from 260.95 m) with maximum grades of 0.217 g/t Au and 10.8 g/t Ag.

- Finally, hole 25CLAU066D extended the Aguilareña vein approximately 90 m down-dip from historical hole 21CLAU003D.

These results demonstrate continued expansion potential along the Aguilareña vein system, with hole 25CLAU065D highlighting significant high-grade gold mineralization in both the main vein/hanging-wall zone and newly identified blind structures in a previously unexplored gap. Combined with successful down-dip and lateral extensions in multiple holes, results demonstrate substantial upside for resource growth north of the historical Aguilareña workings and reinforce why the Company's ongoing Phase II step-out drill program continues to prioritize this prolific vein corridor.

Guadalupana Vein Results

Holes 25CLAU050D, 25CLAU051D, 25CLAU052D and 25CLAU062D were drilled to test the Guadalupana vein approximately 100 to 180 m below historical drill holes.

Holes 25CLAU050D and 25CLAU051D successfully confirmed the vein's presence and continuity at deeper levels, intersecting drilled widths of 5.1 m and 8.6 m, respectively. While silver-gold grades were modest, the intercepts exhibited classic epithermal textures-including milled fragments of earlier banded quartz cemented by later finely banded quartz-indicating repeated hydrothermal brecciation and boiling events. These features are highly encouraging indicators of silver-gold deposition potential at greater depths within the structure.

Holes 25CLAU052D and 25CLAU062D also intersected the Guadalupana vein, albeit over narrower drilled widths and with lower-grade mineralization.

Collectively, these intercepts provide valuable new geological information regarding the subsurface geometry, structural continuity and hydrothermal characteristics of the Guadalupana vein system. The observed epithermal textures and evidence of repeated brecciation and boiling processes are positive indicators of the vein's potential to host higher-grade silver-gold mineralization at depth. They reinforce the Guadalupana vein's strong exploration upside and guide optimized targeting for future step-out and deeper drilling in the ongoing Phase II program, as the Company advances this promising corridor alongside high-grade successes at Aguilareña and recent discoveries elsewhere on the project.

Phase II Drill Program Update

To date, the Company has completed more than 3,650 metres of diamond drilling across 13 core holes using three drill rigs as part of its ongoing Phase II program, which is currently focused on:

- Expanding and following up high-grade mineralized intervals along the Aguilareña vein system;

- Conducting step-out drilling to further evaluate the recent high-grade discovery at the Justina vein; and

- Testing high-priority, previously undrilled targets in the Mina Vieja and Mina de Oro areas.

Additional updates on exploration progress and assay results from the Phase II drilling will be released in the coming weeks and months as results become available.

Quality Assurance/Quality Control

The 2025 drill samples were collected from HQ-diameter core and were logged and sampled at the Pacifica Silver gated and enclosed facility in Santiago Papasquiaro, Durango. Sample lengths varied from 0.15 to 2.45 m, with the majority being ≥ 0.85 m in length. Pacifica Silver geologists marked the core lengthwise to best divide the core into halves, perpendicular to veins, mineralized fractures and vein-breccia. Sample intervals were cut in half lengthwise and one-half of each sample was placed into pre-numbered plastic sample bags with numbered sample tickets and closed with ties. The closed sample bags were placed into numbered shipping sacks along with numbered bags of coarse preparation blanks and certified reference material (CRMs or "standards") inserted with each hole for quality control/quality assurance purposes.

Samples were transported to the ALS Minerals (ALS) laboratory in Zacatecas, Zacatecas State, Mexico by ALS personnel and by commercial package delivery to the ALS laboratory in Hermosillo, Sonora, Mexico. At the ALS laboratories, the samples were crushed in their entirety to 70% passing 2 mm, and riffle split to 1-kg subsamples which were pulverized to 85% at 75 µm. ALS then shipped 200 g splits of the pulverized material by air freight to the ALS assay laboratory in North Vancouver, Canada, for analysis. Gold was analyzed by 30 g fire-assay fusion with an Atomic Adsorption (AA) finish (method code Au AA23); samples with >10 g/t Au were re-assayed by fire-assay fusion and gravimetric finish. Silver plus 34 major, minor and trace elements were analyzed by ICP AES following 4-acid digestion of 0.5 g aliquots (method code MEICP-61). Samples that assayed greater than 100 g/t Ag were re-analyzed by ICP AES following a 4-acid digestion (method code Ag OG62). ALS holds accreditation under ISO/IEC 17025:2017 for specific analytical procedures and is independent of Pacifica Silver.

Qualified Person

Patrick Loury, AIPG CPG, Exploration Technical Advisor for Pacifica Silver, is a Qualified Person for the purposes of National Instrument 43-101 and has reviewed and approved the technical content in this news release.

About Pacifica Silver Corp.

Pacifica Silver Corp. is a Canadian resource company led by a proven management team with decades of mining and exploration experience in Mexico. The company is focused on its 100% owned Claudia Silver-Gold Project located in Durango, Mexico. Spanning 11,876 hectares, the Project encompasses most of the historic El Papantón Mining District where at least nine small mines operated intermittently during the 20th century. Since 1990, sampling and drilling within have returned high-grade silver and gold intercepts across multiple vein systems, with only 10% of over 30 kilometres of known veins having been drilled. Today, the project is a prime target for modern exploration and holds exceptional potential for new high-grade discoveries.

Signed,

Todd Anthony

Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Todd Anthony

Phone: 778-999-2627

Email:

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation as may be amended from time to time, including, without limitation, statements regarding the perceived merit of the Project, expected timeline for permitting additional drill sites, potential quantity and/or grade of minerals and the potential size of the mineralized zones. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold and silver; the accuracy of mineral resource estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of mineral resource estimates, including but not limited to changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, the ongoing war in the Ukraine, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral resources; and risks associated with executing the Company's objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, available on www.sedarplus.ca. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

*All silver equivalent grades (AgEq) expressed in this Press Release are calculated based on the following formula: AgEq (g/t) = Ag (g/t) + [Au (g/t) x (Au price / Ag price) x (Au recovery /Ag recovery)]. Metal prices for silver and gold are assumed to be US $30/oz and US $2,500/oz, respectively. At this stage, insufficient metallurgical test work has been completed to determine recoveries for silver and gold at the Claudia property. Accordingly, recoveries of 93% for silver and 96% for gold were applied, based on the five-year historical average production data reported from First Majestic Silver Corp.'s San Dimas mine. These values are considered reasonable proxies for anticipated recoveries at Claudia due to similarities in deposit style and the relative proximity of the two properties.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284243